The financial industry is undergoing a period of significant transformation, and at the heart of this revolution is blockchain technology. Originally developed to support the cryptocurrency Bitcoin, blockchain has had a profound impact on many aspects of financial operations, ushering in a new era in the world of finance. In this article, we will explore how blockchain technology is changing the banking system and the opportunities and challenges it presents.

Decentralization and Enhanced Security

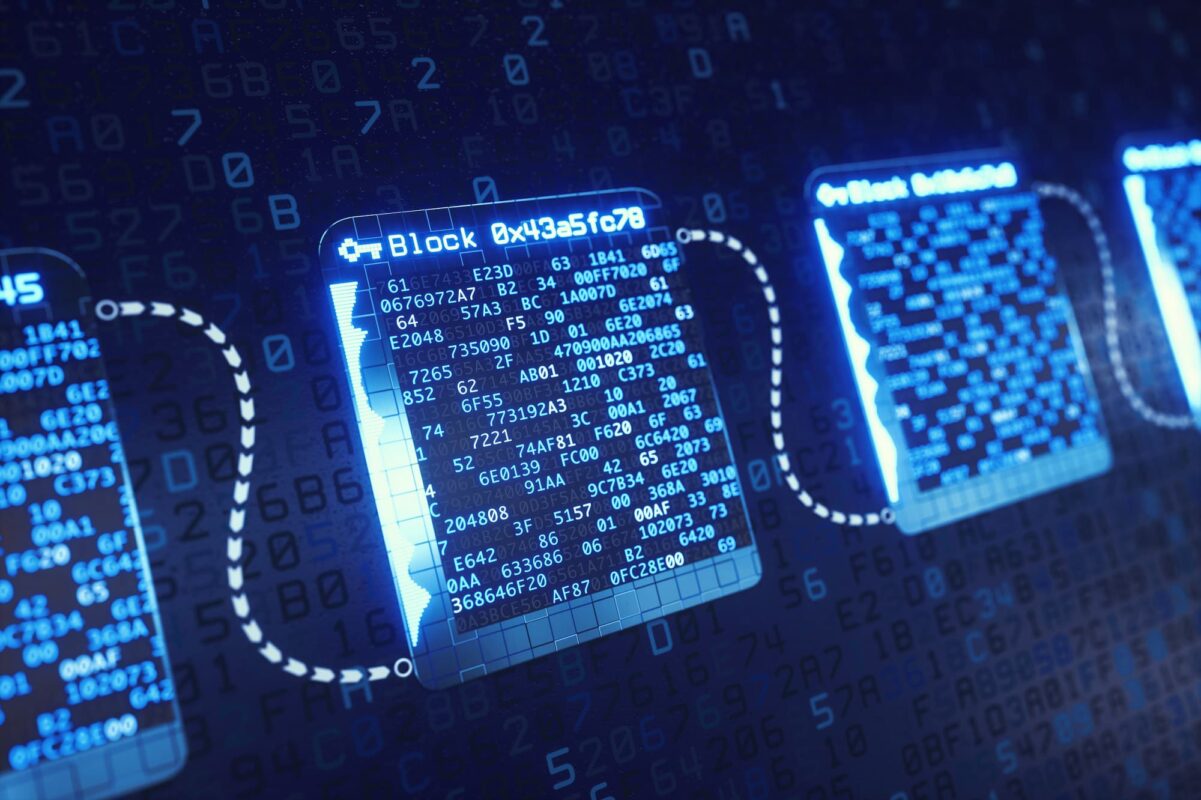

One of the key features of blockchain is its decentralized nature. In the traditional banking system, all financial transactions are processed and stored in centralized databases controlled by banks. In the event of an attack or system failure, this can lead to serious consequences. In contrast, blockchain offers a decentralized approach where data is stored and verified by a network of participants. This makes the system more resilient to attacks and ensures a high level of security.

Smart Contracts and Efficiency

Smart contracts are automated programs that execute contract terms when specific conditions are met. They are built on blockchain technology and can be used to automate various financial operations. For example, they can be applied in credit agreements, insurance, share tracking, and many other areas. Smart contracts eliminate the need for intermediaries and reduce the risk of errors.

Global Accessibility and Lower Costs

Blockchain technology enables instant and global transactions and asset transfers. This means that even small businesses and individuals can participate in the global economy without the need for expensive intermediaries. This reduces costs and lowers barriers to entry for financial transactions.

Regulation and Challenges

However, despite all its advantages, blockchain technology also raises regulatory questions. Financial authorities and governments must develop new rules and regulations to account for the decentralized nature of blockchain and ensure its security. This poses challenges and requires coordinated efforts from all market participants.

Enhanced Transparency and Trust

Blockchain’s transparency is one of its defining features. All transactions are recorded on a public ledger that can be accessed and verified by anyone on the network. This transparency not only reduces the risk of fraud but also builds trust among participants. In the traditional banking system, trust is often established through intermediaries and extensive paperwork. With blockchain, trust is embedded in the technology itself, making transactions more secure and efficient.

Cross-Border Transactions and Financial Inclusion

Blockchain has the potential to revolutionize cross-border transactions. Currently, international money transfers can be slow and costly, with multiple intermediaries involved. Blockchain technology can streamline this process by enabling direct peer-to-peer transfers across borders, reducing fees and transaction times. This can have a significant impact on global financial inclusion, as it allows people in remote areas with limited access to traditional banking services to participate in the global economy.

In conclusion, blockchain technology is ushering in a new era of finance by improving security, efficiency, and accessibility in financial operations. However, it also presents regulatory challenges that need to be addressed collaboratively. The future of the financial system will depend on the industry’s ability to adapt to these changes and harness blockchain technology to its advantage.

Tokenization of Assets

Blockchain technology allows for the digitization and tokenization of various assets, including real estate, stocks, and even art. This means that physical assets can be represented as digital tokens on a blockchain, making them easier to trade and transfer. For example, instead of purchasing an entire property, investors can buy tokens representing fractional ownership, thus increasing liquidity and accessibility to a wider range of investors.

Regulatory Evolution

Regulators worldwide are recognizing the potential benefits and challenges posed by blockchain technology. Many countries are in the process of developing and implementing regulations specific to cryptocurrencies and blockchain-based financial products. These regulations aim to strike a balance between fostering innovation and ensuring consumer protection and financial stability. The evolving regulatory landscape will play a crucial role in shaping the future of blockchain in banking.

As blockchain technology continues to mature, it has the potential to redefine the traditional banking system, offering faster, more secure, and more inclusive financial services. However, it’s essential for financial institutions, policymakers, and the blockchain community to collaborate closely to address challenges and seize the opportunities presented by this transformative technology.